Need help finding an affordable Medicare plan? Make an appointment with KAN!

What’s the difference between Medicare Supplement plans and Medicare Advantage plans?

Medicare Supplement Plans (AKA Medigap Plans):

Reduces your out-of-pocket costs by helping to pay the portion of medical bills that Medicare Part A and B don’t cover in exchange for a monthly fee. You keep Original Medicare as your primary payers.

*Primary payer means who pays first.

Example: You have lab work done at an outpatient healthcare facility. Medicare Part B covers 80% of the medical bill and you need to pay 20%. If you have a Medicare Supplement plan, your plan will cover your 20% portion of the medical bill.

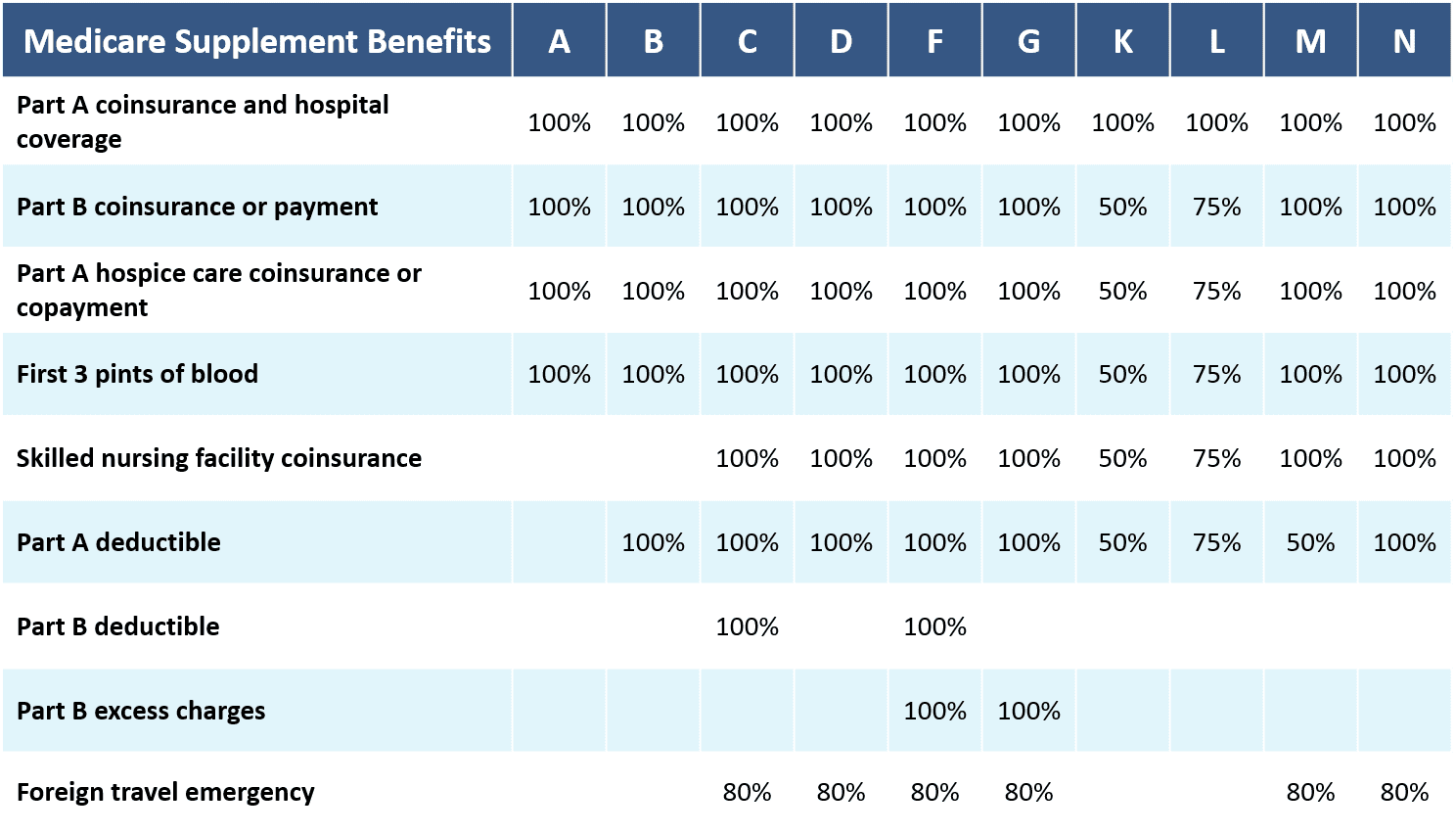

There are only 10 types of Medicare Supplement plans. No matter what company you go with, they cover the same amount based on their category. The difference between Medicare supplement companies is monthly price, length of time selling plans, and potential increases in monthly premiums over the years.

Example: A Blue Cross and Blue Shield Plan M that costs $150 a month covers the exact same things, at the same amount as a Humana Plan M that costs $180 a month.

Newly eligible members on or after 1/1/2020 no longer have the option of Supplement Plan C or Supplement Plan F. All other plans are still be available for purchase. Anyone enrolled in a Supplement Plan C or Supplement Plan F as of 12/31/2019 is “grandfathered” and able to continue with their plan as long as wanted but no one who turns 65 after 1/1/2020 can purchase these plans.

What Medicare Supplement Plans Cover

When can you enroll in a Medicare Supplement plan?

Initial Enrollment Period: A 6 month period that starts the first month you have Medicare Part B (Medical Insurance) and you're 65 or older. It can't be changed or repeated.

*If you don’t sign up for a Medicare Supplement plan during your initial enrollment period, you can sign up anytime during the year but you may not be accepted or may have a higher monthly premium for having pre-existing conditions.

You can switch Supplement plans at any time but may not be able to get a plan with better coverage. Example: moving from a Plan A to a Plan G.

Rules about switching Supplement Plans:

You can switch to an equal or lesser plan category without being denied or charged a higher premium for pre-existing conditions.

You can try to switch to a plan category with more coverage but may be denied or charged a higher premium for pre-existing conditions. Also, the new benefits covered by the plan may not be in effect until 6 months after purchasing the plan.

Plan ahead! When choosing a Supplement plan it’s important to think about the coverage you may need someday instead of the coverage you need right now because you may not be able to switch as you get older especially if your health declines.

Pros of Medicare Supplement Plans:

You can go to any doctor or hospital that accepts Medicare (about 97% of all providers in the US)

You may pay less for services upfront

You don’t need a referral to see a specialist

All medically necessary services will be covered and do not need to be pre-authorized by your plan

You can travel out of your state and still be covered

Some plan categories cover limited medical care outside of the United States

Cons of Medicare Supplement Plans:

You will pay a monthly premium

There is no maximum-out-of-pocket

Prescription drug coverage is not included

Only covers 1 person at a time

Vision and dental are not covered

If you choose to switch from an Advantage plan to a Supplemental plan, you may be asked questions about your medical history and be charged a higher monthly premium

Medicare Advantage Plans:

Replaces your Medicare Part A, and B (and usually D) with traditional health insurance. The advantage plan is your primary payer.

These plans can be HMOs, PPOs, SNPs, or PFFs. Just like traditional health insurance, they will have annual deductibles and out-of-pocket maximums.

When can you enroll in Medicare Advantage Plans?

Initial Enrollment Period: When you turn 65 or become eligible for Medicare

Annual Open Enrollment: October 15th - December 7th

Medicare Advantage Open enrollment: January 1st through March 31st

*You can switch Advantage plans during this period but you must already have one.

Open enrollment for 5 Star Advantage Plans: December 8th through November 30th.

Pros of Medicare Advantage Plans:

You may not have to pay a monthly premium

You will have a maximum-out-of-pocket

Usually includes prescription drug coverage

Can cover married couples together

Some plans offer vision and dental coverage not offered by Original Medicare

Some plans cover a gym membership or have extra “perks”

You don’t need to answer questions about your medical history if switch to or between plans

Cons of Medicare Advantage Plans:

Plans have networks so you may not be able to go to your preferred doctor or hospital

You may need a referral from your primary care doctor to see a specialist

You may not have coverage outside of the state you live in

Plans may require pre-authorization for certain services and you could be denied treatment

You may pay more out-of-pocket upfront for some services

Has yearly open enrollment periods so you’re stuck with the plan you choose for an entire year before you can change.

If you want to go back to Original Medicare and/or buy a Supplement Plan after having an advantage plan, you may be asked questions about your medical history and pay higher premiums for your new plan.

Medicare Advantage Plans vary greatly depending on the company and type of plan you choose. There is no standardization like with Supplemental Medicare Plans so you will need to view each plan individually to learn about what they cover.

Can you have both a Medicare supplement and an advantage at the same time?

No. If you have a Medicare supplement plan, YOU CAN NOT SIGN UP FOR A MEDICARE ADVANTAGE UNLESS YOU CHOOSE TO DROP YOUR SUPPLEMENT PLAN. You will need to choose one or the other and can switch back but your monthly premiums might go up depending on age and health. Medicare Supplement plans pay for medical expenses that original Medicare does not cover.